Mention that you’ve become a real estate agent and you’ll likely get asked whether that’s wise, given the state of the market. For sure, the real estate market isn’t where it was a year or two ago. But it’s pretty far from dire.

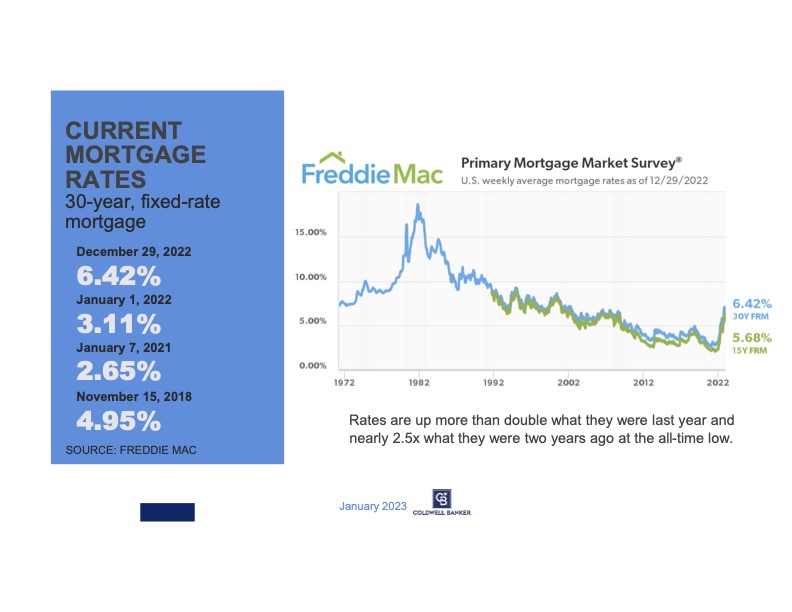

Media coverage tends to gravitate toward rising interest rates and declines in sales volume. The two are related, and the Federal Reserve raised its benchmark short-term rate by a quarter-point this afternoon, to 4.75%. The tea leaves on that, though, often get misread.

The two numbers are closely related, and the third leg of this triangle is the number of properties on the market. Someone with a fixed-rate mortgage that was initiated or refinanced in the recent past certainly is less likely to sell up and buy a new home with a loan at a higher rate. As a result, the inventory of homes for sale remains much lower than normal. The homes on the market continue to sell at robust prices — the median sales price in Worcester remains higher than the median listing price because demand remains high.

Don’t forget that the Fed slashed interest rates to record lows to combat the economic effects of the COVID-19 pandemic. Along with that, the government was literally giving away money to most Americans to blunt the pandemic’s effects. What followed was a very abnormal jump in real estate sales as buyers and sellers alike looked to take advantage of the economic climate. The market (and a large part of the economy as a whole) became overheated. Since then, the Fed pushed the funds rate higher in bulky three-quarter-point increments four times last year. That’s cooled the economy down considerably. But the Fed’s action today shows that it’s likely closer to leveling off interest rates.

Today, though, looking beyond the near past, interest rates are at pretty typical levels. The Fed still has work to do to reduce inflation (and further firm up the economy in the process). But, for real estate, demand remains. It just comes down to supply.

Bryan Lantz is a Realtor with Coldwell Banker’s office in Worcester, Mass. He can be reached at bryan.lantz@cbrealty.com.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link